research

Kenneth Arrow presents BSE Lecture "The Economy as an Interactive Information System"

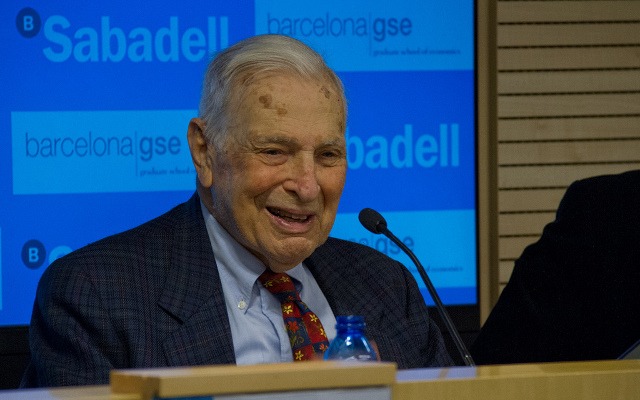

The 23rd BSE Lecture, "The Economy as an Interactive Information System," was presented by Prof. Kenneth J. Arrow (Stanford University) on March 22, 2012 at Banc Sabadell Auditorium in Barcelona.

A Nobel laureate in Economics (1972), Prof. Arrow was in Barcelona to participate in the biennial meeting of the BSE Scientific Council, an external group of distinguished economists that analyzes the educational activities, research initiatives, and institutional development of the School. Prof. Arrow is one of 11 Nobel laureates on the Council.

Information as an economic commodity

In his lecture, Prof. Arrow offered observations on the role of information in the creation of economic theories, models and forecasts.

"Information is endogenous to the economic system," Prof. Arrow said. "It plays an essential role in directing the allocation of resources above and beyond the role of the prices of the usual commodities. Moreover, information is itself a commodity, being both scarce and valuable, but it has properties that make it unique. The special properties of information make the usual modeling of allocation through a market of limited use," he said.

Markets, he explained, are influenced by the role of knowledge and belief. "A key factor in the organization of the economy is the set of beliefs that people have about each other. They change those beliefs by searching, by computing, by analyzing, and when looked at properly, this gives rise to some considerable anomalies when compared with the standard theories that I and many others have developed. So in some sense, I’m finding some difficulty with work I’ve done in the past," he said.

Prof. Arrow cited economic disturbances both recent and past as examples of erratic behavior that are not adequately explained by standard economic theory.

The complexity of information acquisition

Many factors contribute to the complexity of information acquisition, including the rate of information diffusion, intellectual property protections, and the very choice of which information to use. This choice is often based on the cost of the information itself and the time required to obtain it.

"Information is an economic proposition and a product of decisions," Prof. Arrow said. "The chain of information is based on inferences and information choices made by others. Can we really make a forecast if all forecasts depend on others' forecasts, and so on?"

Ultimately, time constraints and other limiting factors lead to inaccuracies and to the collapse of belief. "Because information structures are shaky, when extended they can lead to excessive reactions and collapse," Prof. Arrow said. "We know it's true in practice–can we make it true in theory too?"

About Prof. Kenneth Arrow

Kenneth J. Arrow (PhD, Columbia University, 1976) is Professor of Economics (Emeritus) at Stanford University. He shared the Nobel Memorial Prize in Economics with John Hicks in 1972. He is a Fellow of the American Academy of Arts and Sciences and a recipient of the National Medal of Science. He is a member of the BSE Scientific Council.